|

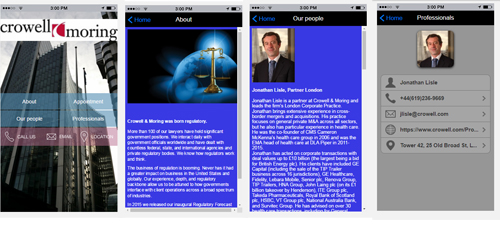

Jonathan Lisle

Partner

London

T:+44.20.7413.1331

M: +44 7769 142326

E:jlisle@crowell.com

PARTNER Jonathan Lisle is a partner

at Crowell & Moring and leads the firm's London

Corporate Practice. Jonathan brings extensive experience

in cross-border mergers and acquisitions. His practice

focuses on general private M&A across all sectors,

but he also has particular experience in health care.

He was the co-founder of CMS Cameron McKenna's health

care group in 2006 and was the EMA head of health

care at DLA Piper in 2011-2015.

Jonathan has acted on corporate transactions with

deal values up to £10 billion (the largest being

a bid for British Energy plc). His clients have included

GE Capital (including the sale of the TIP Trailer

business across 16 jurisdictions), GE Healthcare,

Fidelity, Lebara Mobile, Senior plc, Renova Group,

TIP Trailers, HNA Group, John Laing plc (on its £1

billion takeover by Henderson), ITE Group plc, Takeda

Pharmaceuticals, Royal Bank of Scotland plc, HSBC,

VT Group plc, National Australia Bank, and Survitec

Group. He has advised on over 30 health care transactions,

including for General Healthcare Group, Spire Healthcare,

Ramsay Health Care UK, Nuffield Health, The Priory

Group, LGV Capital, and Sovereign Capital.

Click image to enlarge

HEALTHCARE

Crowell & Moring has a market leading Health

care practice and its 32 dedicated lawyers? advise

on all aspects of Health care transactions and operations

both in the U.S. and in Europe.

Our lawyers deliver comprehensive legal solutions

to complex business and regulatory challenges, including

major corporate transactions such as mergers &

acquisitions, joint ventures and outsourcing transactions.

We also provide strategic and day-to-day counsel on

compliance with applicable legislation, including

health insurance regulations and health information

privacy and security laws.

Examples of recent matters include advising:

• Humana Inc. in its $35 billion sale by merger

to Aetna Inc. (antitrust counsel)

• Health Net, Inc. in its $6 billion sale by

merger to Centene Corporation (regulatory counsel)

• Blue Shield of California in its $1.2 billion

acquisition of Care1st (regulatory counsel)

• Health Plans (including Aetna, Cigna, Health

Net and WellCare) in pharmacy benefit management outsourcing

arrangements each involving multiple billions of drug

spend per year

• Aetna Inc. in its $405 million acquisition

of Active Health Management Inc.

• Health Net, Inc. in its $140 million sale

of its Medicare PDP business to CVSCaremark and related

commercial matters

• QuadraMed Corporation, a publicly-traded

healthcare and hospital information technology company,

in its $126 million sale by merger

|